In this article, you will find a comprehensive explanation of the W4 Form 2024: What is a W-4 Tax Form, Who Can Fill It, and Complete Details. Every citizen of the country must fill out the W4 Form 2024 for the tax year. The employer shares the details such as the social security number and personal details of their employees after receiving the Employee’s Withholding Certificate. This article provides the individuals with the necessary information. W4 Form 2024

W4 Form 2024

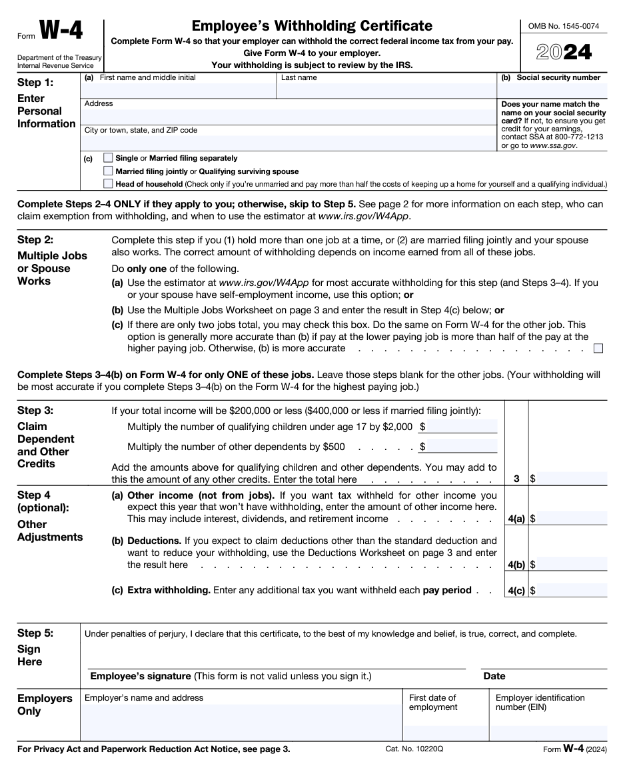

W4 Form 2024 – An employee withholding certificate must be completed with the required information in order to be valid. When taxpayers enter their family, dependents, marital status, employment, total expenses requirement, income sources, and other details on the W4 Form, they receive a paycheck.

A form must be filled out by the applicant and it includes information such as the name, address, social security number, and contact information. However, those who are exempt from taxes do not need to submit the exemption form to the Internal Revenue Service.

What is a W-4 Tax Form?

To help US Citizens pay their taxes, the form is filled out. The form allows taxpayers to provide the withheld amount to their current employer. Since most of them pay higher amounts, the form is filled out. Upon request, the paycheck can be used for depositing Federal taxes.

To get the form, the applicant has to provide the details of their dependents (children or an older individual) or their law partner who lives with them. IRS.gov is the link to the website where the form can be obtained.

Who Can Fill It and How?

The employees must submit the form to receive their paychecks. This is essential for paying the required taxes for the current fiscal year. The government must keep track of the citizens’ financial statements.

Tell the IRS when your marital status changes or your dependents no longer live with you. If the taxpayers cannot fill out the form themselves, they can get assistance from IRS officials to submit it for them. The image above shows the form and the steps to complete it. The IRS will modify the application to provide the maximum benefits.

W4 Form Complete Details

When the form is submitted, employers will pay $1500 to the candidate. The candidates may have to pass a procedure for verification. When you become a regular taxpayer, you will receive the withholding amount. The government will penalize citizens who earn but do not pay taxes. You will have to provide proof of your income sources and your assets.

You will receive an Employee Withholding Certificate once your application is verified by the IRS. Your current employer will withhold the tax. Make sure you enter all the appropriate details in the form to avoid any issues in the future.

W4 Form Tax Exemption

The IRS wants to ensure transparency in the working of the withholding system. Therefore, the regulation applies to both taxpayers and exemptions. This simplifies the process of examining an individual’s finances.

Individuals who do not earn any income and who do not pay any taxes are exempt from filling out the W4 Form. Please note that federal credits will not be provided to you if you do not complete the W4 Form.

Internal Revenue Service and W 4 Form

The IRS authorities manage the financial aspects of the country. They do this by checking the tax returns of citizens and analyzing whether the individual can be subjected to the credits or not. W4 forms are important because they allow employees with dependents to reduce their total taxable amount. However, this does not mean they are sharing fake applications.

The officials prefer to be disciplined, so the company has provided a regulation for such a form. The employer can ensure the total expenses of the employee and provide fewer benefits to those who have higher expenses than expected.